The Z Trader FX EA is a robot that has been created to work on the EUR/USD. It does no use a Martingale strategy and it is not designed to scalp trades. Rather, it is an EA that is designed to use low risk to conduct swing trades on the trading account. At $117 and $137, this forex robot is actually one of the cheaper ones out there.

Z Trader FX EA: To Trust or Not to Trust?

The Z Trader FX EA has been examined by us and we have found that it is an EA that can be trusted. This trust score was decided on after we conducted a thorough analysis of the software performance data over the last two years. Our assessment found that the software has been largely profitable in the instances of trading history that are shown on Myfxbook. We also believe that there is a measure of transparency in the advertising of the product and the display of its performance data.

Let’s look at these metrics one after the other.

Good Trading Results Which Show Consistency

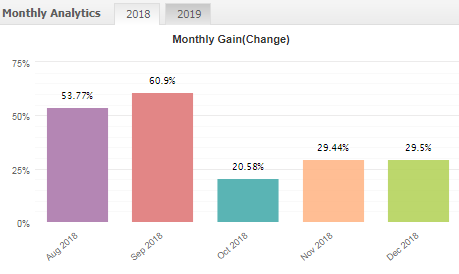

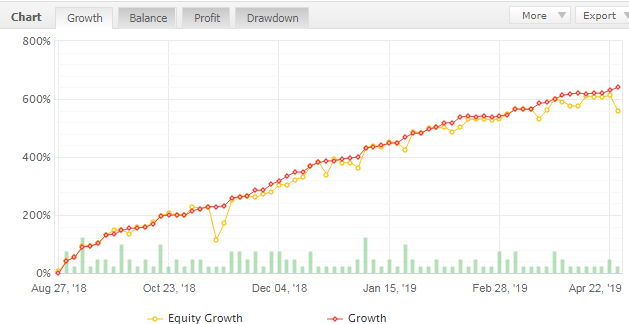

A study of the month-by-month performance of the Z Trader FX EA shows that this forex robot has been posting profits consistently. Aside from the fact that it has posted a 640% gain in the last one year of trading which spans mid-2018 to the present day, we can also see that this EA has hardly had a losing month.

2018’s performance was indeed very stellar, and 2019 has built upon this performance. The only bleep was the low profit for April 2019, but hey; it was still a profitable month.

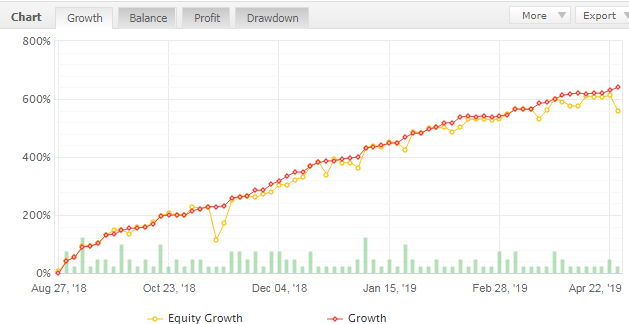

A complete picture cannot be provided on this EA’s profitability until a study growth and profitability charts is made. These two charts show a progressive line pattern that is angled at 45 degrees to the upside, showing that growth is just optimum. The chart is neither too flat nor too steep.

This profit growth chart shows a trading style that is not risky and which ought to be encouraged. Any surprising spikes or dips to a great degree will suggest a drop-off in performance along with an attempt to win back losses in revenge trades. We do not see this in Z Trader FX EA.

Low Drawdowns

The system used by the Z Trader FX EA has a drawdown rate of less than 4%, which is very good. This means that the robot is not unduly taking risks and does not subject the trader’s account to a barrage of market punches while going in for the kill. Most trades seen in the Myfxbook instances were taken with 0.01 lots. The strategy here is obviously to use low risk and chase many pips in profit, as opposed to many other software out there that try to chase pips with large lot sizes.

A Tad of Transparency

The vendors of the Z Trader FX EA software have to be commended for at least showing some level of transparency in the display of their trading results. We have seen cases where trade data was made private and critical performance analytics were blocked off or erased by the vendors, in an attempt to mask some unsavoury details. With Z Trader FX EA, we do not have this. All trade data is displayed for public scrutiny.

Conclusion: To Trust or Not to Trust?

On the strength of this review, we believe that the Z Trader FX EA is a software to trust. It uses low risk, has low drawdowns and above all, has shown profitability on a live account. We would have loved to see some reviews (positive and negative) from verified users. In the light of this, we would still add that traders should use the EA with caution despite the “Trust” score.