Developed and sold by FX Automater, the Wall Street Forex Robot 2.0 software comes as a 4-in-1 software package which includes a so-called “Broker Spy” software, which is able to checkmate the activities of fraudulent market makers. FX Automater boasts that the Wall Street Forex Robot 2.0 has “the longest, fully Myfxbook verified performance on real-money accounts in the EA industry”. Well, that is a very strong claim, and now we review the software to see exactly how true this is.

Wall Street Forex Robot 2.0: To Trust or Not to Trust?

After our thorough review of the Wall Street Forex Robot 2.0 robot, we do not believe that this software really performs as the FX Automater team claims it does. Therefore, this is a software not to trust.

But how did we come to this conclusion? We looked at the following parameters:

- Trade performance data

- Transparency factors

- Correctness of Claims by Vendors

So here is how each of these analytics held up under our scrutiny.

a) Trade Performance Data

A multi-year chart that shows the performance of the Wall Street Forex Robot 2.0 robot from 2016 to date reveals that the software has actually had negative growth.

You can see this on the chart above. The essence of trading with a forex robot if anything, is to get superior performance than would be possible via manual trading. Therefore, not only should the robot be making money, it should be able to beat human systems in terms of performance. We do not see this from the performance chart above, which shows that the robot is actually losing money on a live account.

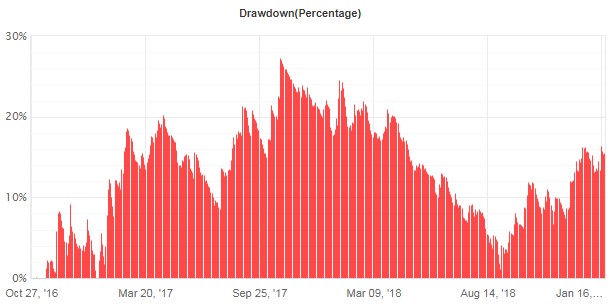

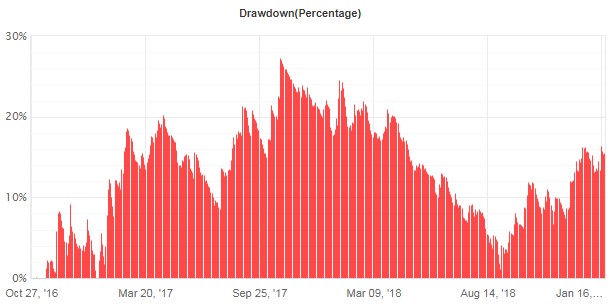

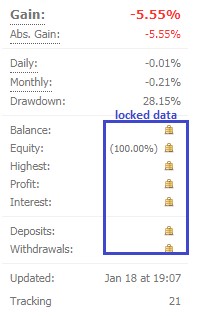

We also see problems in terms of drawdown with the Wall Street Forex Robot 2.0 robot. Drawdowns have constantly been above 10% in the entire trading period under review.

High drawdowns are a risk to any trading account as they increase the risk of ruin. The Wall Street Forex Robot 2.0 robot seems not to have any in-built mechanisms to combat this problem.

b) Is this Software Transparent?

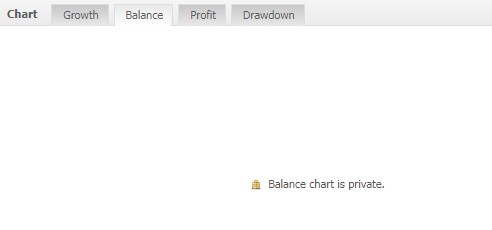

The answer to this question is: NO. There seems to be a lack of transparency about the real trading performance of the Wall Street Forex Robot 2.0 robot. The summary of data that shows the trade results has been locked on Myfxbook.

The Balance Chart as well as the Profit Chart is locked:

Locking of such critical data can only connote one thing: a concerted effort to hide information about the performance of the software. There is a lot of information that can be deduced from a profit or balance chart. So the question must be asked: where is the transparency when such critical data is blocked from the public?

c) Veracity of Claims

There are a few things that we observed in our review which seem to contradict some of the claims made by the vendors of this software. First, we look at the statement on the FX Automater website:

The website states that performances are on “real money” accounts, but the snapshot below, also pulled from the FX Automater website, shows Myfxbook snapshots that were taken from demo accounts! See the area marked off in red below.

This is a clear case of contradiction of the claims made by vendors of this software. Furthermore, the snapshots displayed on the site only seem to come from occasions where the fx robot ran successfully (and a lot of these were on demo accounts, not real-money accounts). There seems to be a deliberate attempt to eliminate the instances where the robot failed woefully. We believe disclosure should be total and not partial or skewed in an attempt to deceive unsuspecting buyers.

Conclusion: To Trust or Not to Trust?

Wall Street Forex Robot 2.0 is a forex robot which cannot be trusted. We have assessed the software and found several points of deficiency which will definitely militate against successful operations on trader accounts.

The software’s performance can still be improved upon by the FX Automater team. But until they do so, the software cannot be trusted.