Today’s review covers TradeRobo EA, which is a forex expert advisor that is built for long-term trading (according to the webpage of the product). The team behind TradeRobo states that the robot can only work under optimal conditions, defined by a trading capital of at least 5,000 Euros which targets an annual yield of 25-50%. The software uses a Grid strategy which trades on 24 forex pairs.

The software costs 121 Euros for a month’s subscription and 321 Euros for a period of three months. The TradeRobo EA is now reviewed to see whether it can be trusted or not.

TradeRobo EA: To Trust or Not to Trust?

As is the case with many other EAs out there, there is always the question of whether the TradeRobo EA is worth all the hype. We need to review the performance of this software to really understand its workings and find out if there are reasons to trust or not to trust this software.

After a review of the performance analytics of TradeRobo, the verdict on this software is that it cannot be trusted. Here are some reasons why the TradeRobo EA is software not to trust.

- High drawdown rate -> excessive risk

- Poor trading performance

- Pricey product

Let’s look at the scam metrics one by one.

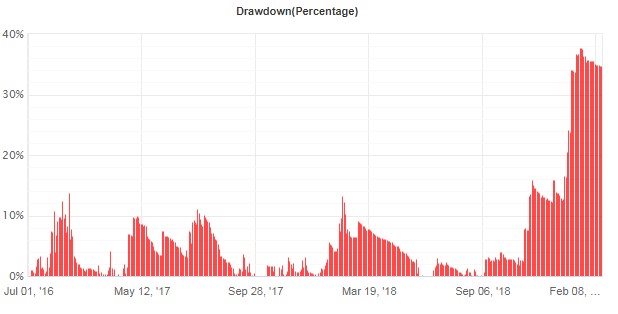

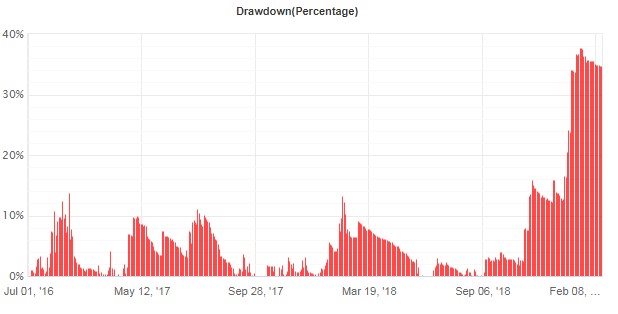

High Drawdown

The TradeRobo EA has been hit with persistently increasing drawdown percentages. This year alone, drawdown has increased to nearly 40%, which is very high. Such high drawdowns increase the possibility of ruin on a trading account. We can already see this drawdown beginning to impact trading outcomes.

For an forex EA which is supposed to be trading with a long-term focus, where results can still be achieved with very little risk, a 40% drawdown level is unacceptable.

Poor Trade Performance

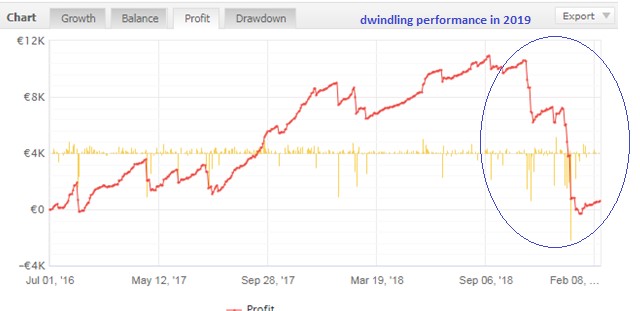

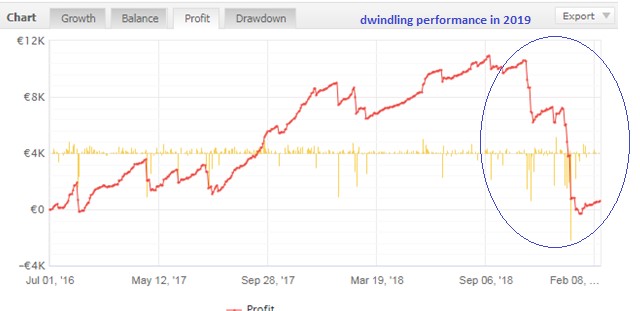

A snapshot of the profit performance chart of TradeRobo EA on Myfxbook shows a modest 3% gain. This may not paint a very bad picture, but you may want to hold that thought as you look deeply at the numbers.

First, a look at the chart itself shows a massive drop-off in performance for 2019, after a chequered performance that was largely to the upside in the 2nd half of 2018. The steepness of the drop in the performance curve shows just how bad things have got with TradeRobo.

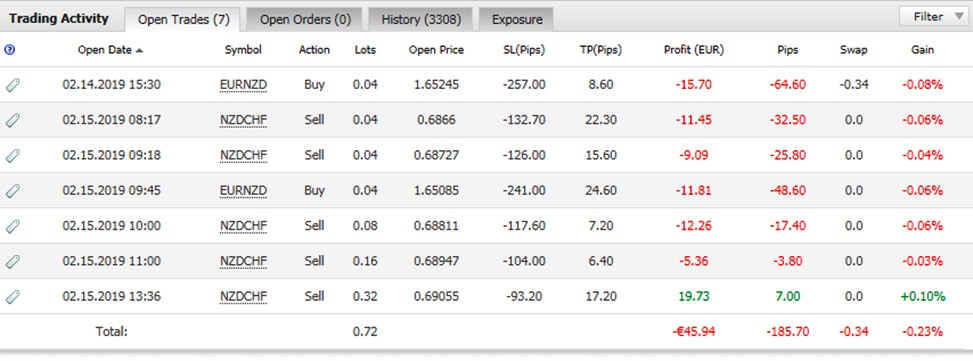

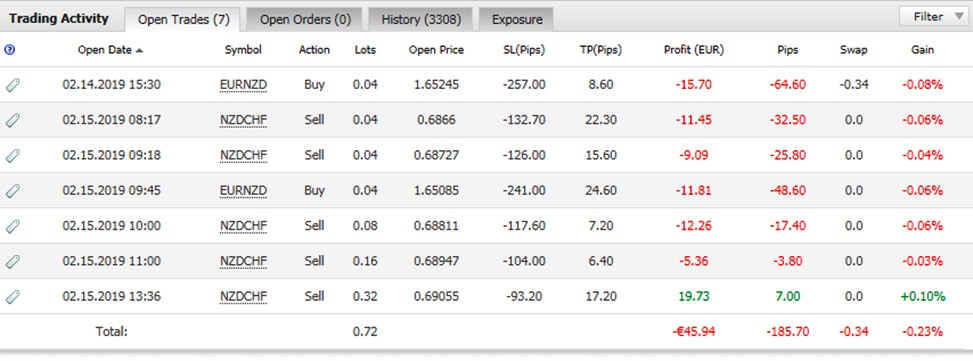

Now that we have seen how the profit curve looks like, let us look at the figures that have produced such a performance drop. A look at the trading history for the week just ended (February 14-15, 2019) shows several open trades that are all in the red!

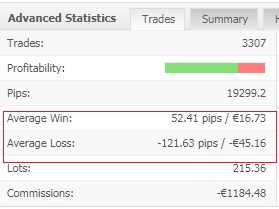

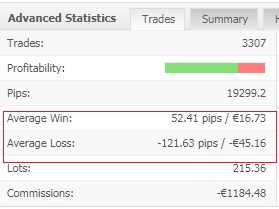

Furthermore, an analysis of the win-loss ratio for the shows that winning trades are being cut short and losses are being allowed to run.

The results are clear: we have in TradeRobo a forex robot which is obviously disobeying acceptable risk management standards, does not give adequate returns for risk taken, and which is underperforming as far as its results in 2019 are concerned.

Overpriced Product

At 121 euros a month, it is our opinion that the TradeRobo EA is overpriced. Pricing should be tied to performance. To collect 121 euros a month or 321 euros every three months in advance for a robot with such faltering performances is almost akin to being stiffed.

Conclusion: To Trust or Not to Trust?

TradeRobo EA is a forex service not to trust. We have based our findings on the following:

- High drawdowns, low risk-reward ratios, and several other metrics which point to a software that is using excessive risk to achieve its goals.

- Poor trading performances for the year, which have erased in a few weeks, what the software made in the last 6 months of 2018.

The verdict is simple: TradeRobo EA is a software not to trust.