Just as its name suggests, Titan Scalper EA is a forex robot which operates by taking short scalps in the market. Average trading time ranges from a few minutes to a maximum of 3 hours. This review will take a look at the forex robot known as the Titan Scalper to see if it one that you can trust with your money or not.

Titan Scalper: To Trust or Not to Trust?

The key question is whether the Titan Scalper robot is a software to trust or not to trust. After a thorough review of this software, we have opted to give this software a cautious pass mark, pushed mainly by the strength of its performance in 2018 and its March 2019 trading performance.

Despite the strong performances, there are some reservations which we have about the software, but these can be overcome by the trader by application of some risk mitigation strategies.

Here is a more detailed description of the Titan Scalper’s appraisal from our team, which ended up getting them a cautious pass mark.

- Good history of profitability

- Some lack of transparency

- Apparent disregard to acceptable risk-reward ratios.

These points are examined one after the other.

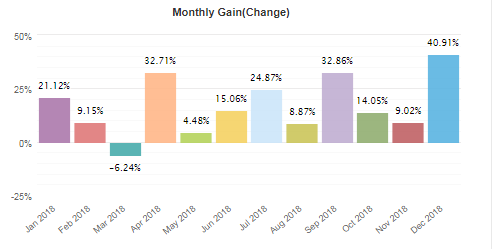

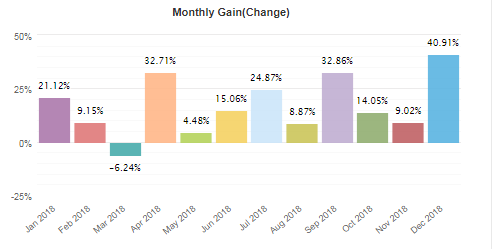

Good History of Profitability

The performance of a version of the Titan Scalper was reviewed and it was found to show some good profitability. The snapshot below is the trading performance for 2018, showing only one losing month. Not only was this losing month just a 6% loss, but some of the winning months showed profitability that was 3-4 times more stellar than the losing month in question.

2019 started slowly, but performance for March 2019 was 242% in profit. So this is one scalping robot that has shown considerable promise in terms of what it can make.

Titan Scalper 2019 Performance

Also helping the cause of the Titan Scalper is the fact that drawdowns are currently less than 5%, which is quite good and shows that the fx robot is not using excessively risky strategies to make money.

Some Lack of Transparency

It has been noticed that there is some lack of transparency with the data displayed for Titan Scalper. A lot of data that could have contributed some more information as to the performance of Titan Scalper has either been blocked by the owners of the EA, or has been deliberately locked. Some other instances of performance of the Titan Scalper have been deleted.

We also do not know for instance, whether there was an account deposit to boost trade sizes before trading for March 2019 was done. It would have been better to have all information displayed for deep analysis. Without this, we cannot but leave a question mark along the way.

No Regard for Acceptable Risk-Reward Ratios

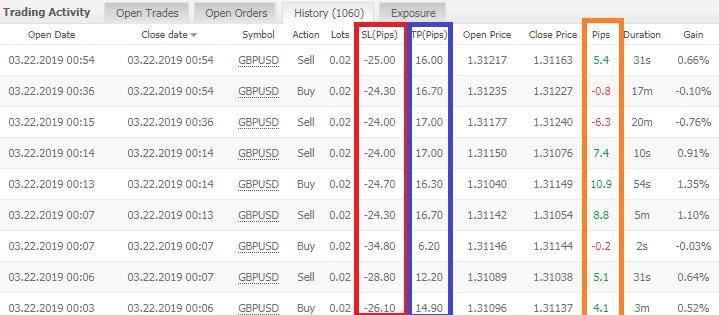

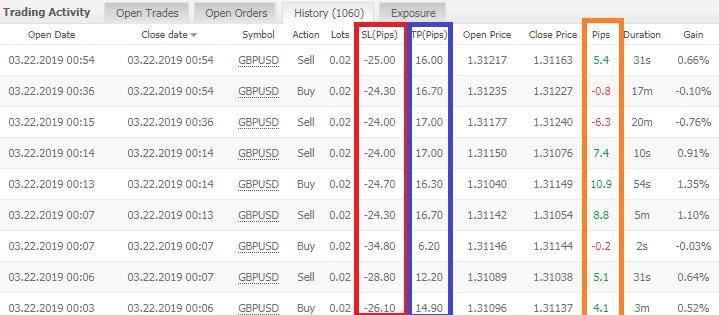

A good risk-reward ratio should see a forex robot target at least 3 pips for every pip set as stop loss. Titan Scalper does not seem to obey this rule, as we consistently see from its trading history that more risk is being taken for less reward.

Take the 1st trade. 25 pips is used as the stop loss (risk), 16 pips is used as the TP (reward) and the trade only earned $5.4. This is a total risk reward of nearly 5:1, which is very dangerous. What this means is that if price triggers the stop loss, it will nullify any profits won in 5 trades. Thankfully, this has not happened, and that is because the trades are being closed manually.

What happens when the trade process is left entirely to the robot? It is a disaster waiting to happen.

Conclusion: To Trust or Not to Trust?

Titan Scalper may have shown profitable results, but there are some risky aspects to its operation. The risk-reward ratios being used by the Titan Scalper are against acceptable standards. If the trader is able to monitor all trades and close them off when few pips are gained, things will go well. But all it takes is for a momentary lapse in focus, and a bad trade could turn things on their heads.

This is why we have awarded the Titan Scalper EA a cautious pass mark. It will only continue to be profitable with human intervention.

Thanks for review

Thanks for review