So… It’s everything you can find on The Wave Scalper’s page. Okay… Not so much. The screaming headline and the same abstract, and there are no links. Googled and made some researches we’ve found out two company’s accounts on myfxbook: Leapfx and forexGBPAvenger.

The Wave Scalper: To Trust or Not to Trust?

No, you shouldn’t. If you have to google trade results of a forex robot you want instead of finding them in the official presentation it’s the first call that you’ll be screwed.

Mid trade results

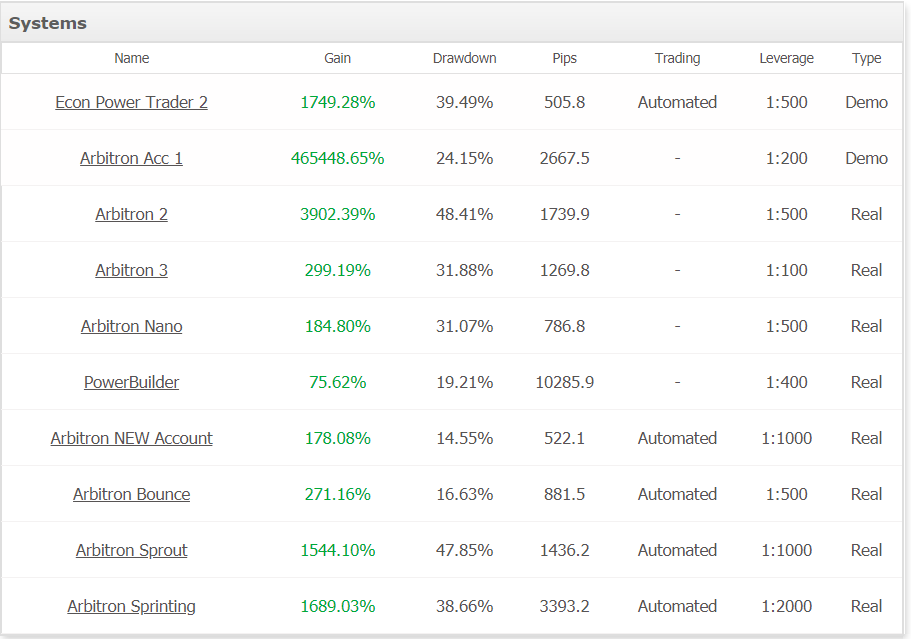

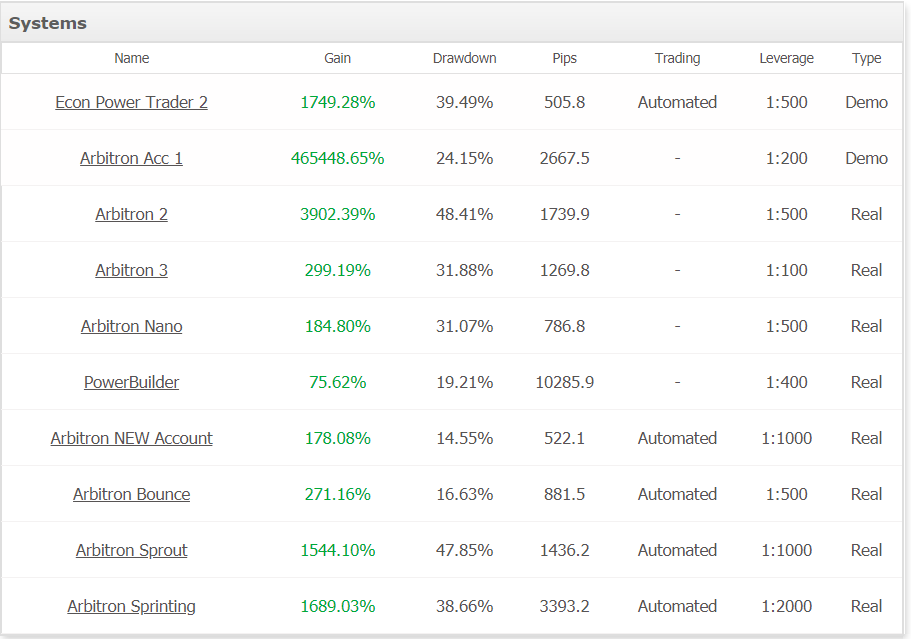

The first account is all about Arvitron performing.

We keep it for the next review.

The second one includes a lot of strategies by applying WS patterns.

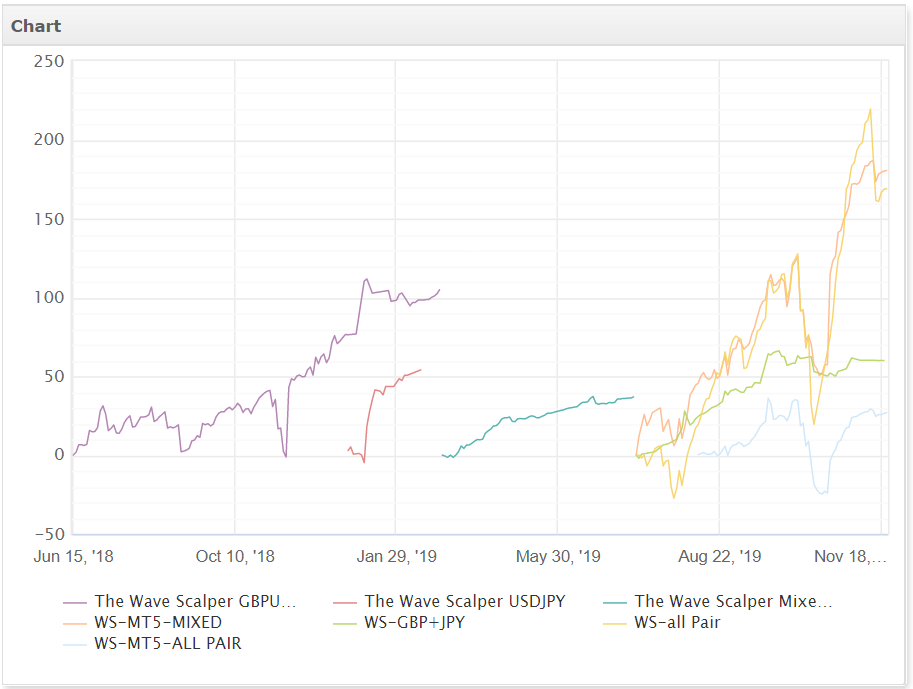

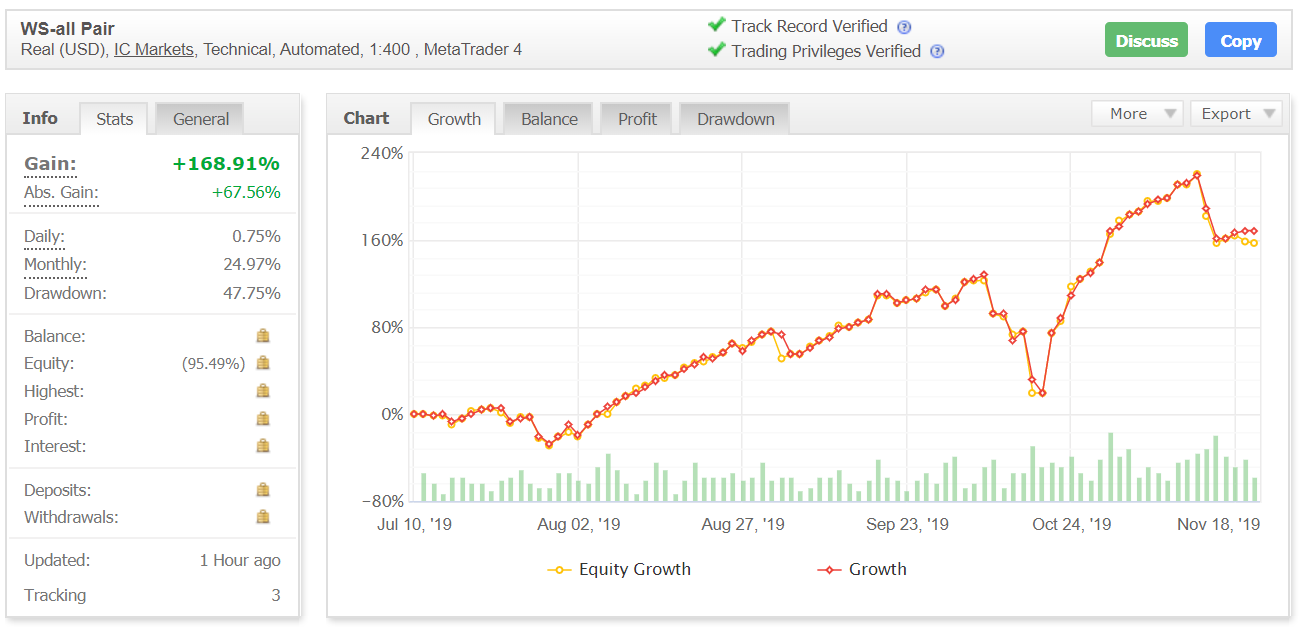

Let’s peek WS-all Pair. This one looks closer to what people can get from “the box”.

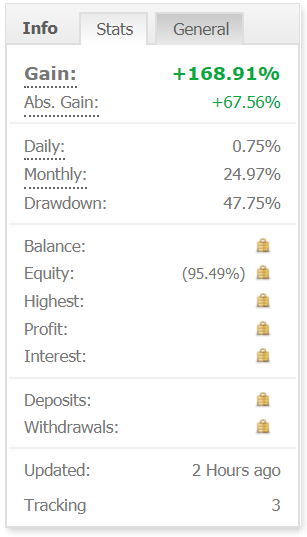

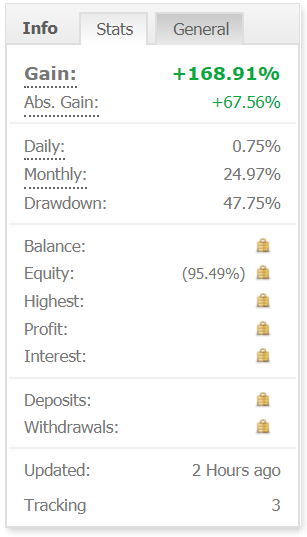

As you can see, the account has been deployed in July 2019 and still working. For the five months, it gained +170%, showing 25% of the monthly gain. It’s a kinda good result.

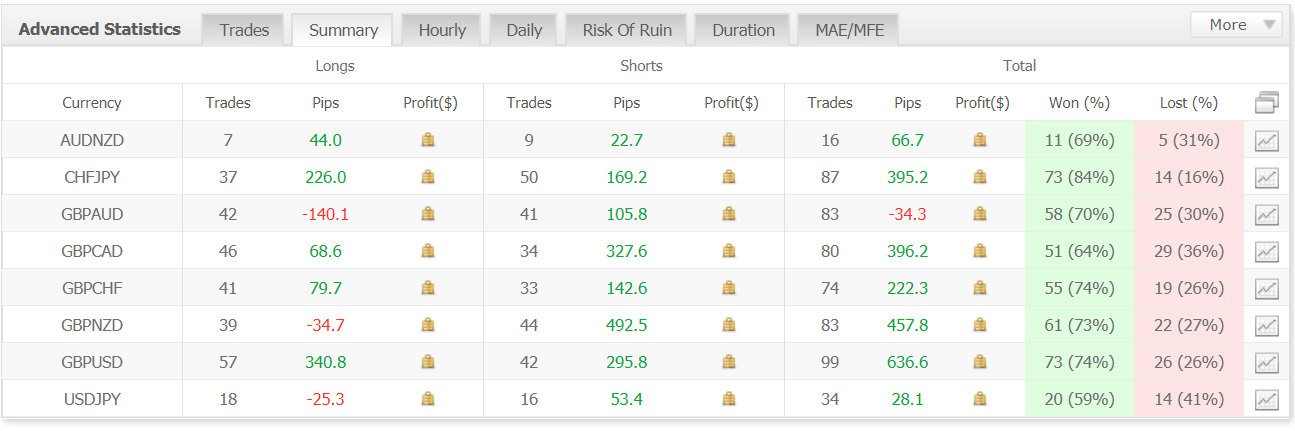

During the period, there have been performed 556 deals and 2168 pips, where 72% of them were won. The average trade length is about 5 hours.

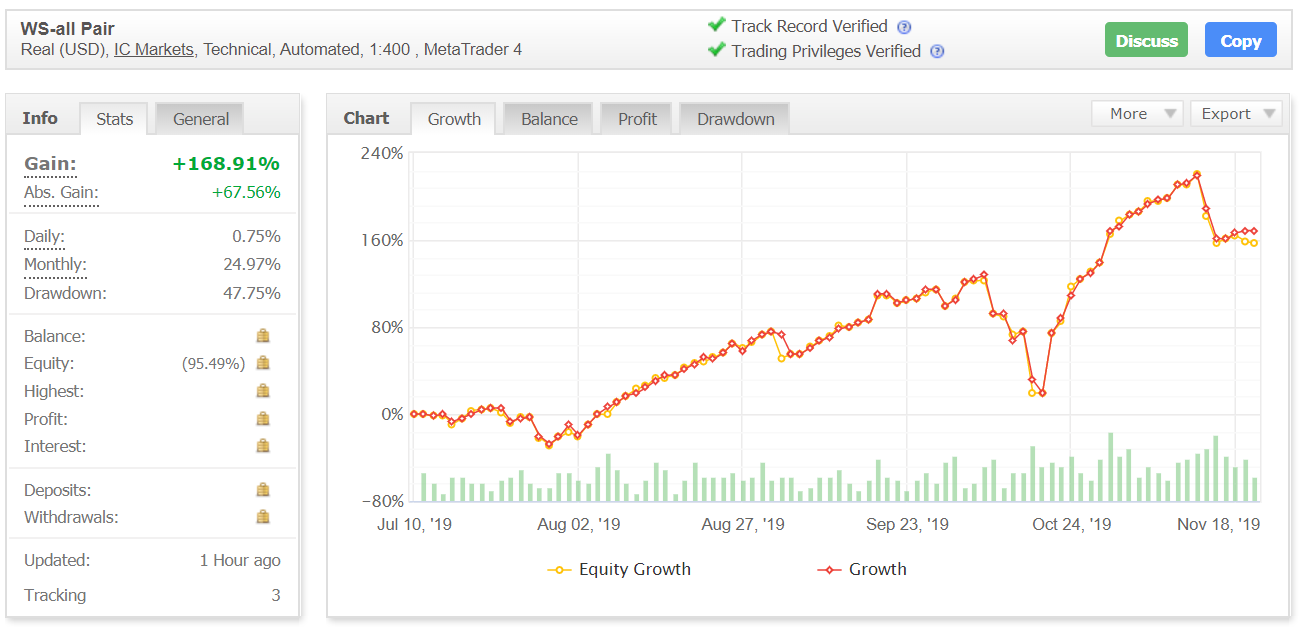

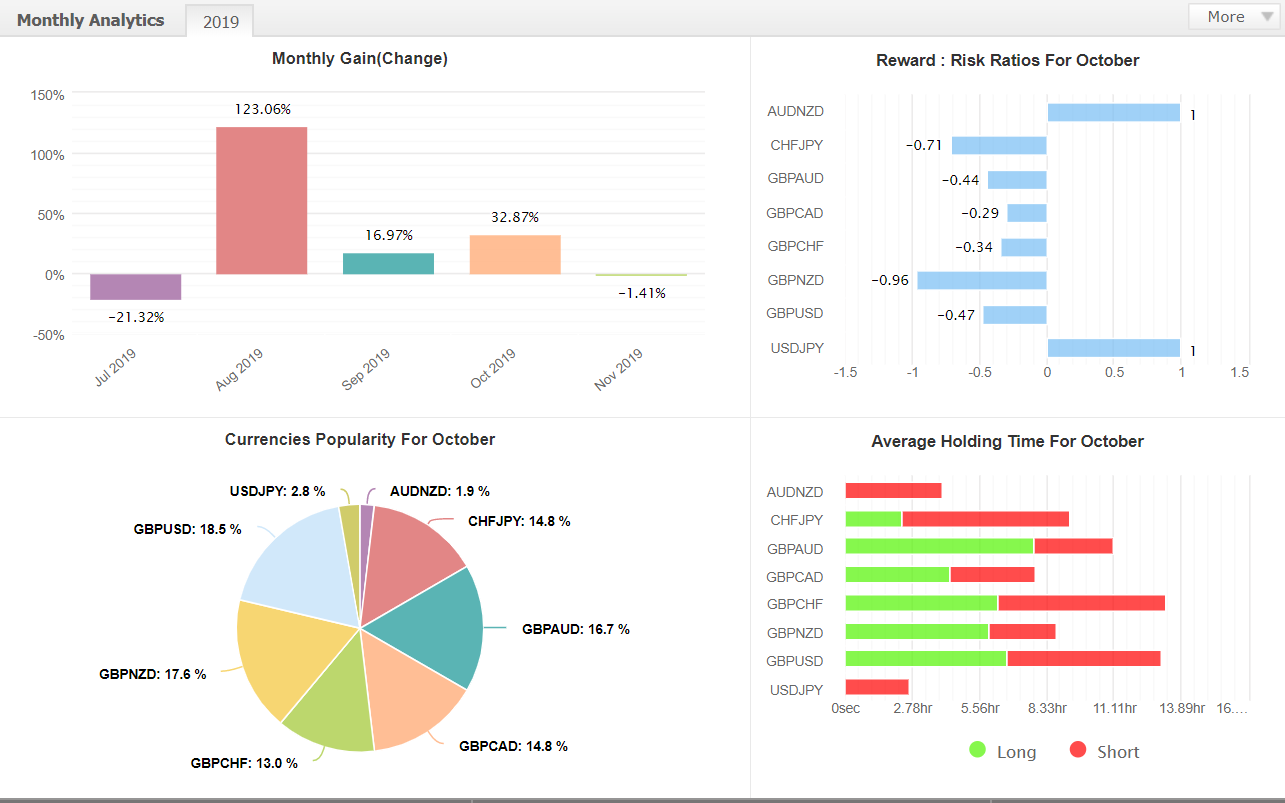

October’s 2019 results look like.

As we can see, the fx robot traded practically six currency pairs.

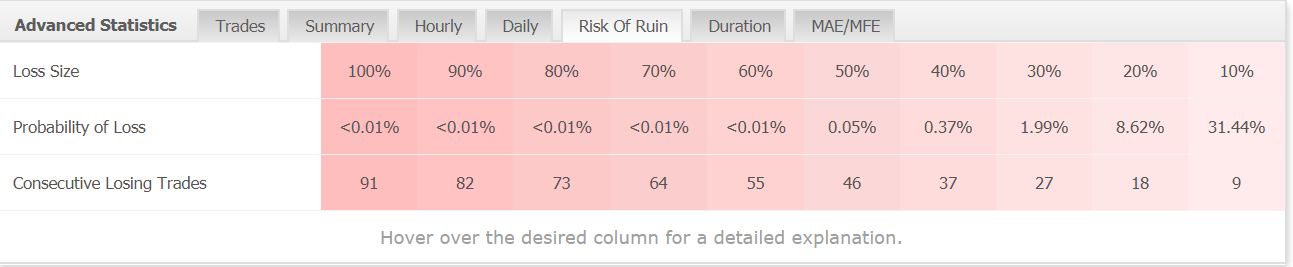

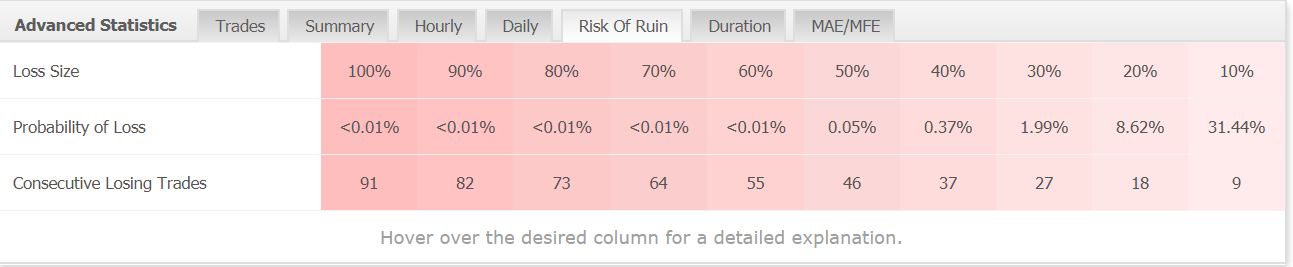

The Wave Scalper works with high-risks, which’s proven from the spread-sheet.

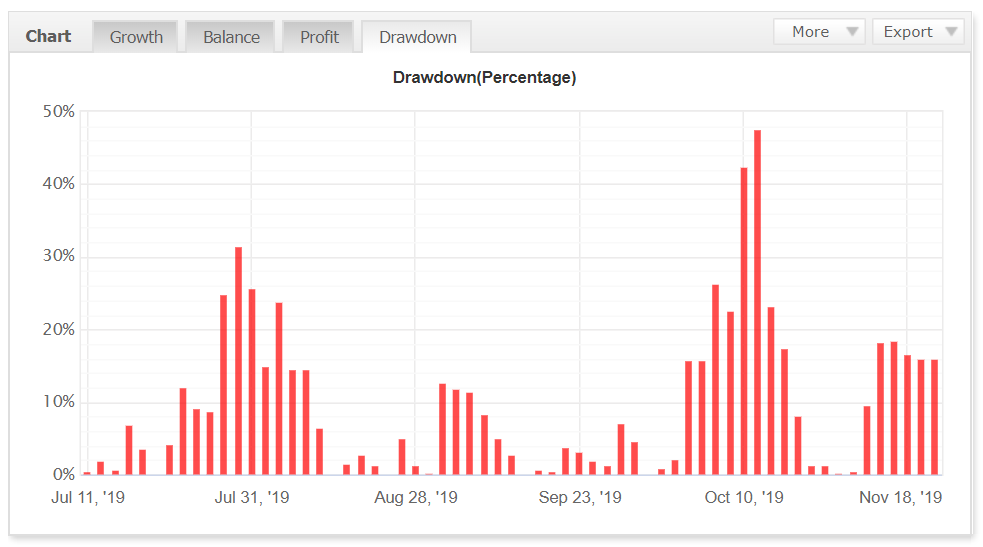

Very high level of Drawdowns

Drawdowns are almost 48%.

Lack of Transparency

You can see from the screenshot that a lot of data has been hidden from visitors.

Lack of proving data always drives to doubts.

Conclusion: To Trust or Not to Trust?

We were suggested by from 100% to 700% of profit with safe risk. There’s no save risk on the account which has gained 168% for 5 months. The account runs with high risks. Running the account with the save risk level brings you less than 100% of annually gain.

After all, we think The Wave Scalper manages to find its clients. We’d like you to make a final decision about trying the robot.