FXStabilizer EA is a forex robot that is being marketed by an unknown team. The FXStabilizer EA is available in two forms:

- The Durable form (which is equivalent to a mode with a conservative risk management setting.

- The Turbo format (which uses a more aggressive strategy.

It also comes in two versions: FX Stabilizer Pro (which costs $669) and the FX Stabilizer Ultimate version which costs $449. There are also currency-specific versions for the EUR/USD and AUD/USD, which go for $295 each. This makes FXStabilizer a pricey product.

The team behind the software claims that a 30-day 100% refund guarantee is in place for users who are unsatisfied with the product’s performance. To what extent has FXStabilizer held up to the numerous profit snapshots it displays on its sales page? Can this fx robot be trusted?

FX Stabilizer EA: To Trust or Not to Trust?

The FXStabilizer EA has been reviewed by our team and has been classified as a software that cannot be trusted. Here are the reasons for assigning this rating to the FXStabilizer:

- Poor trading results.

- Very high drawdown levels

- Bad reviews on top review sites

Here is a breakdown of how the “not to trust” rating for this software was derived.

Very Poor Trading Results

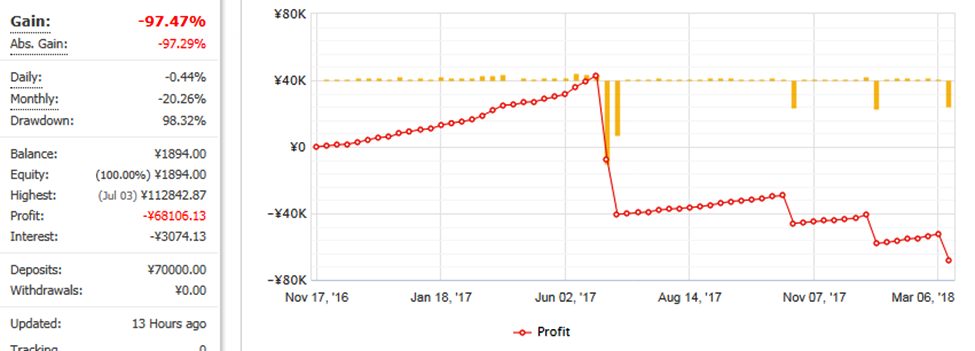

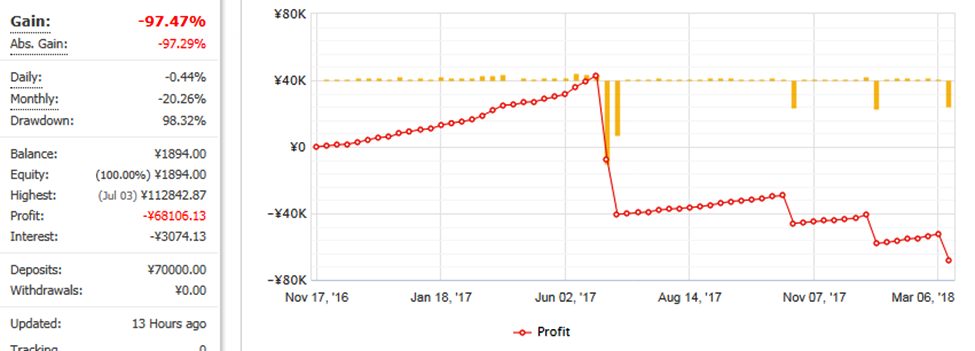

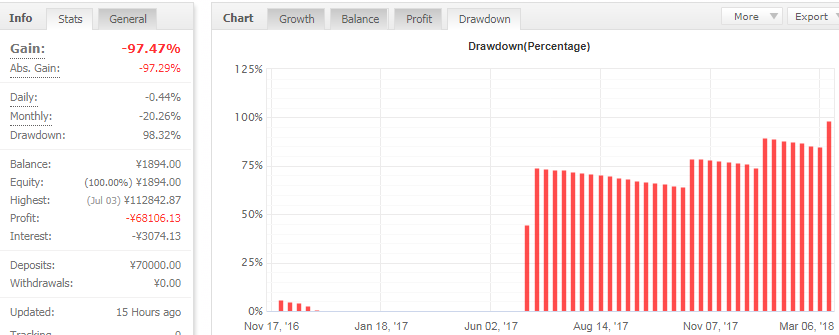

The first thing to look for in any automated forex software is profitability over a long period. FXStabilizer EA has some trading history on several accounts, and several of these are displayed on Myfxbook. The results of one of the instances of the results displayed on Myfxbook show a very poor performance of the robot. Over time, the robot sustained losses of close to 80,000 Yen, which equated to 97% of the account.

The profit chart for FXStabilizer is shown above. Special mention must also be made of the pattern of the line chart, which shows areas where the robot sustained very steep losses, almost in a staircase pattern. This is indicative of a ramp-up in risk in an attempt to bolster the profits that were initially obtained, with a few trades. Unfortunately, the risk with this type of trading style is that losses can be quite devastating when they occur. Indeed, the first actually led to a loss of 50% of the account capital!

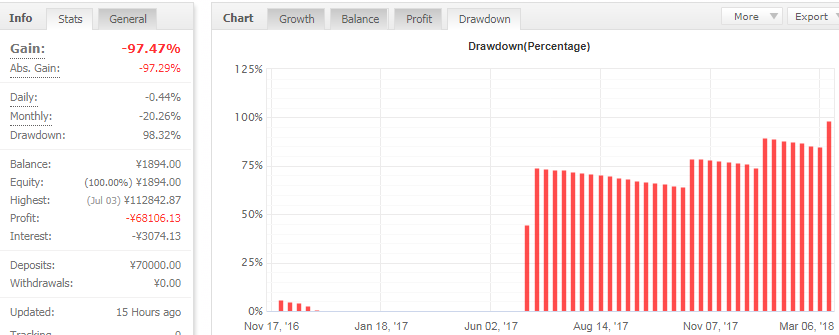

Massive Drawdowns

The FXStabilizer EA currently has a drawdown of almost 100%. This means that the account is close to ruin and in all probability, cannot be recovered without injection of fresh capital.

As you can see, drawdowns were steadily increasing until it got to a peak of 97%. This is a sign of unacceptable risk management inherent in the strategy that powers the FXStabilizer EA.

Negative User Reviews

There are several online reviews about the FXStabilizer EA from verified users, and unfortunately most of these reviews have been negative. Here are just two of these reviews, which confirm the trade results shown on Myfxbook.

Compare the statements in this review and the snapshot of the trade result shown on Myfxbook. The profit chart shows a period of initial profits, after which the account balance began to decline in step-wise fashion. This is one review that clearly describes this pattern.

This is another review which seems to suggest that the team behind the FXStabilizer is not complying with its own policy of issuing refunds within 30 days to unsatisfied customers. This smacks of betrayal of trust.

These two reviews say all that needs to be said about this software.

Conclusion: FXStabilizer EA Is Not to Be Trusted

The poor performances of this software as well as numerous negative reviews which have received no rebuttal from the team behind FXStabilizer are sure signs that the FXStabilizer EA cannot be trusted. No one wants to pay such high amounts for a non-performing robot. A ‘not to be trusted” stamp of disapproval is hereby issued to FXStabilizer.