The FXCharger is a robot that has been created to work with pairs containing the Euro and the Aussie Dollar, particularly the EURUSD and AUDUSD pairs.

FX Charger: To Trust or Not to Trust?

The key question is whether the FXCharger robot can be trusted or not. We decided to conduct a thorough analysis of the software. We found out that the software has been largely profitable in the instances of trading history picked up on Myfxbook, which is quite commendable. However, there are some early warning signs that the software’s great performances of 2017 and early 2018 may have started to drop off. The concerns we found with the FX Charger software are as follows:

- Good results which are now faltering

- Excessive risk which has resulted to increasing drawdown levels.

Let’s look at these metrics one after the other.

Good Trading Results, But Weakening Performance

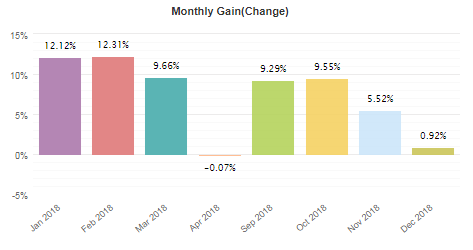

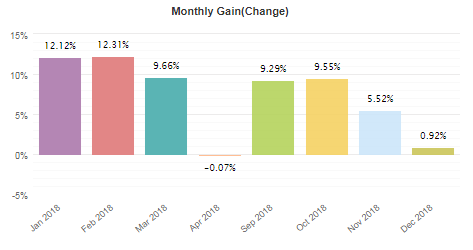

The month-by-month performance analytics for FX Charger reveal a trading software that looks like it is in decline, even though it is still posting profits. As can be seen from the bar chart below, performance on a monthly basis has been waning since January 2018. Profits have fallen from as high as 12% in January 2018, to a low of 0.92% in December of the same year!

This may not look like a big deal, but the fact is that once performance starts to wane, we will start to see the robot using larger trade sizes in an attempt to keep up the performance rates. This always has the tendency to end badly as a heavy loss could easily damage an account to the point of ruin. In another trade instance for the software, this is already being seen. The snapshot below shows two of such trades in which trade sizes were increased almost 100-fold. One turned out well while the other did not quite turn out right.

This style of trading is extremely risky and should not be encouraged. Suddenly ramping up trade sizes in violation of all known rules of risk management is a disaster in waiting: it would not be surprising if some users have experienced this already.

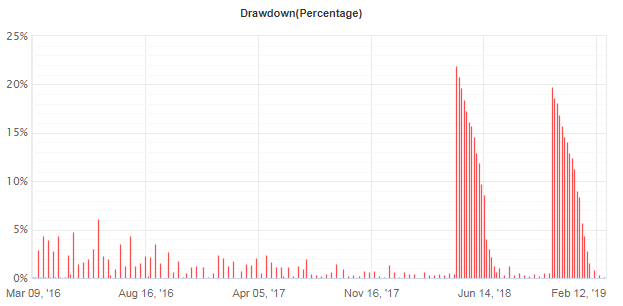

Increasing Drawdowns

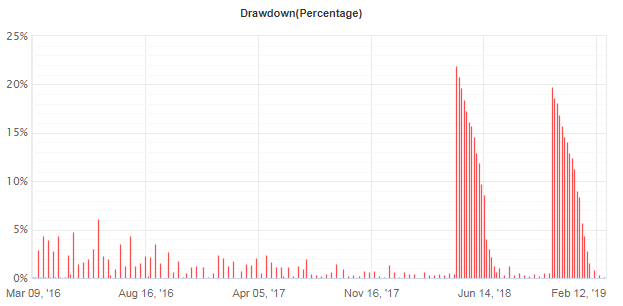

The strategy used by FX Charger has already been shown to be profitable, albeit with gradually decreasing profitability. This is now causing the robot to start trading larger sizes that violate risk management rules, in an attempt to compensate for the reducing profits. This is now evident in the drawdowns, which are now getting larger.

Notice the sharp increase in the drawdown percentage which has coincided with the worst performing months of the FX Charger robot. The robot is now starting to take undue risks in its trading strategy. If things are not sorted out soon, drawdowns may get to untenable levels and this may put the accounts of users at risk.

A Few Good Reviews, But Many Bad Ones

As suspected, some users have started to have issues with the FX Charger software, especially those who procured it when decline in profitability had already set in. One user complained that the software has simply not worked out.

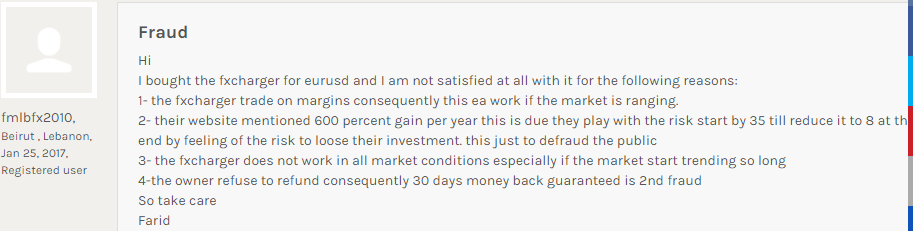

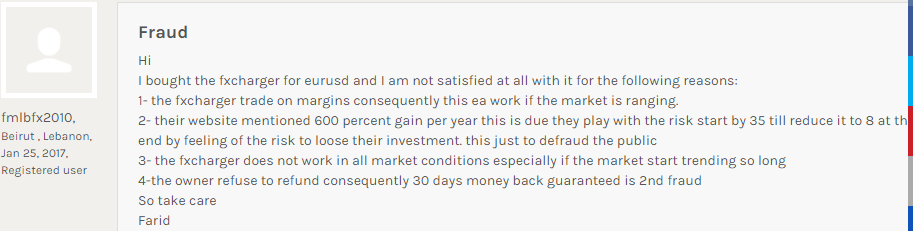

Yet another user has also complained that the software has a lot of problems. This user was particularly detailed about the issues noticed with the software.

The team behind FX Charger has failed to provide answers or rebuttals to these bad reviews. So we can simply assume that the FX Charger robot has some issues which have not been resolved to the point of awarding a pass mark in our “Trust” meter.

Conclusion: To Trust or Not to Trust?

On the strength of this review, we believe that the FX Charger software can only be minimally trusted, and even at that, with a lot of caution. The software can indeed be profitable, but the team probably needs to revisit the robot’s algorithms to perform certain tweaks that will bring out the best in it. Special attention must also be paid to the risk management strategy of the FX Charger software.