Forex Spectre is a software whose vendors claim has made a furore in the market by gaining 3,000%! Usually, when these sorts of figures are bandied about by sellers of forex robots, it will attract a certain degree of excitement from unsuspecting traders and at the same time, some extra scrutiny from the pros. That is why we are going to look at the Forex Spectre EA to see if it actually one that can be trusted or not.

Forex Spectre: To Trust or Not to Trust?

Can the Forex Spectre robot be trusted? In order to make a determination of this, our team has studied various aspects of the software’s operations. Our verdict is neutral: the software cannot be fully trusted, and neither can it be fully distrusted.

Why have we come to this conclusion?

- The software seems profitable from available data, but its trade history is too short to provide a conclusive affirmation of performance data.

- Blatant disregard of acceptable risk-reward ratios.

- Mixed reviews.

These points are examined one after the other.

Profitable But Short History

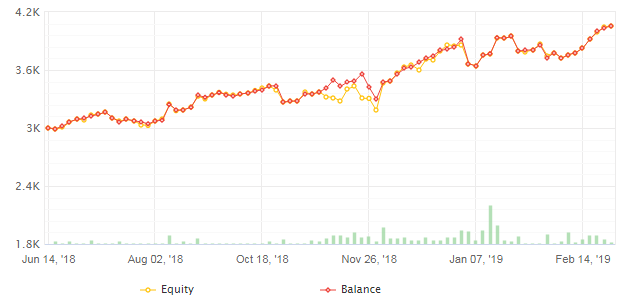

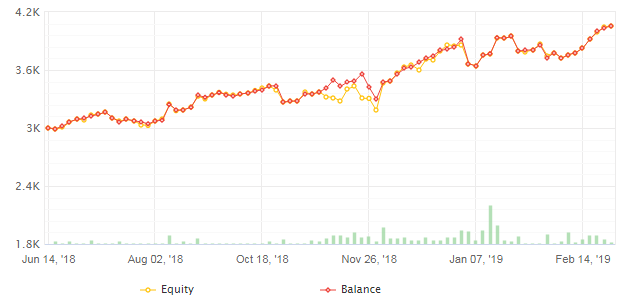

Forex Spectre shows some profitable history on the Myfxbook statement, but the history is for just 6 months, which is not really enough to determine whether this robot has the potential for evergreen performance. The chart shows that the capital has grown 25% in 6 months, equating to a 4% monthly profit.

Drawdowns are also low: at 6%, this is an acceptable figure. While the performance looks good, we need to see more history to see how the robot holds up with evolving market conditions.

Blatant Disregard for Risk Management

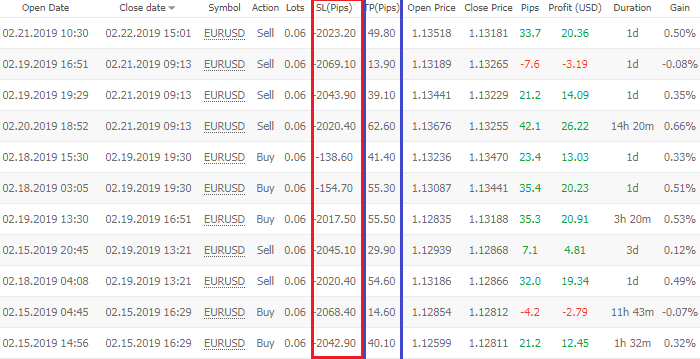

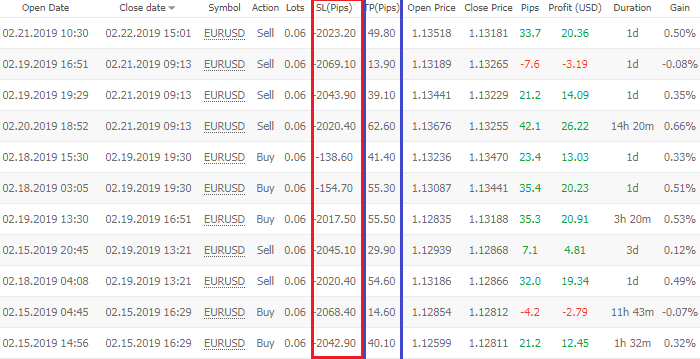

Any profitable forex trader will tell you that the only way to stay profitable in the long term is to target more pips per pips risked. Risk-reward therefore should be at least 1:2 or 1:3. Where 2 or 3 pips are targeted for every pip risked. Forex Spectre simply is not obeying this rule. Look at the snapshot, which shows the first trade carrying a stop loss of 2,023 pips for a profit target of approximately 50 pips. This is almost a 40:1 risk-reward ratio: highly appalling! The use of such risk-reward ratios by the Forex Spectre EA is unacceptable.

Furthermore, we can see that the fx robot is not actually trading to completion, but trades are being closed off manually. While this is not entirely out of place, one would think that performance stats being reeled out on the sales page of the Forex Spectre EA should actually be based on complete performance, without human intervention.

Mixed Reviews

Not everyone is enamoured by the performance data of Forex Spectre. This is captured in this review below, where the user of the software did not have very good things to say about the robot.

We are also a bit concerned by the lack of positive reviews for this software. Surely, an EA that is being touted as capable of delivering 3,000% should have loads of positive reviews, but this is not the case here.

Conclusion: To Trust or Not to Trust?

Forex Spectre may have shown some profitability over a short time, but there are some aspects of its operations we find very worrying. Taking on massive risk while chasing a little reward, is simply not a sustainable way of trading. At a risk-reward ratio of 40:1, a single big loss on this software will take out not just the earned profits but the entire account. So do not trust Forex Spectre fully. Be extremely cautious if you have to use it.