At $349 for a single-user license, the Easy Walker FX is one of the more expensive automated forex robots out there. It is a multi-pair scalping software which is deployed mostly in trading the Asian session. According to the developers of the Easy Walker FX EA, the essence of using this software during the Asian session is to trade when the markets are quieter, so that it is able to scalp pips from various pairs without being subject to the intense volatility of other trading sessions.

Easy Walker FX: To Trust or Not to Trust?

The key question is whether the Easy Walker FX robot is a software to trust or not to trust. After a thorough review of this software, we have opted to give this software a cautious pass mark. In other words, you can trust the software but with plenty of caution. Here are some reasons why Easy Walker FX received this appraisal rating from our team.

- Good trade results overall, but poor results so far in 2019

- Lack of transparency.

- Disregard to acceptable risk-reward ratios.

These points are examined one after the other.

Good Overall Performance, But Poor 2019 and 2020 So Far

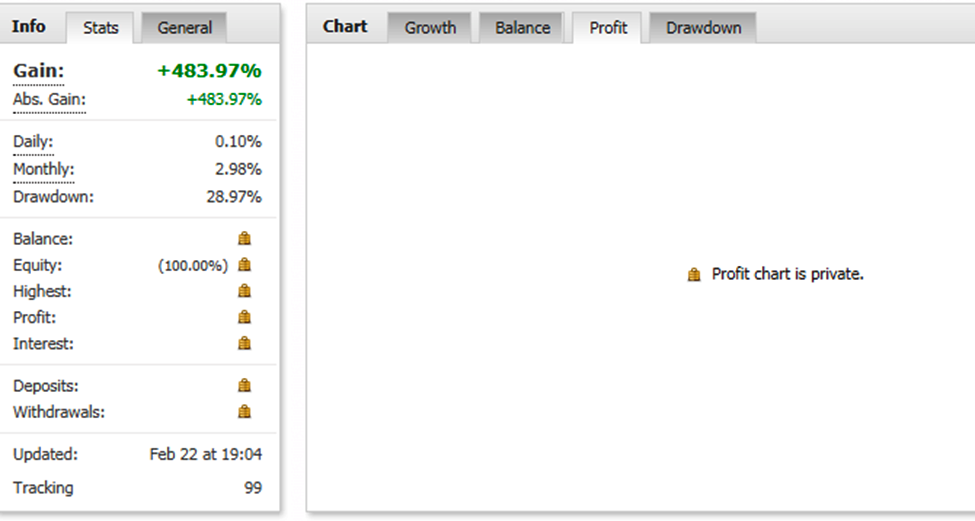

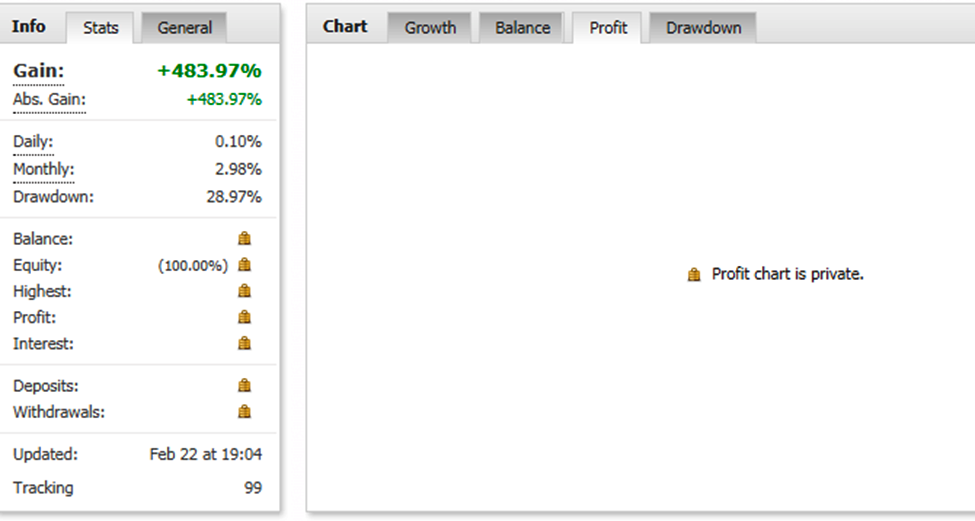

Overall, Easy Walker FX appears to be doing well, as its performance overall over a 4-year period has been profitable. This can be seen from the figures stated to the left of the Myfxbook statement.

We can see the profit chart for Easy Walker FX, showing the progressive growth of the account since 2014. We can also see several steep dips along the uptrending profit chart, showing times when the EA lost money.

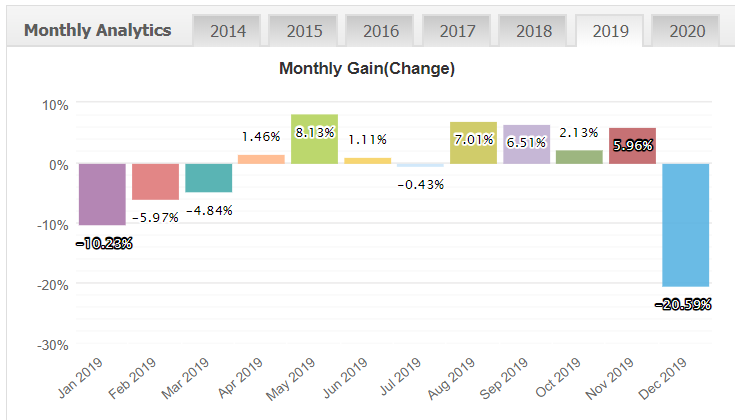

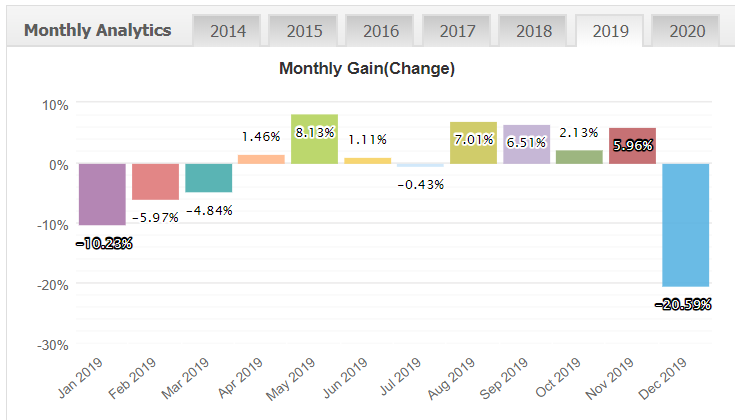

However, a closer look at the numbers will show that the EA’s performance in 2019 is really nothing to write home about. Look at the snapshots below:

You can see that the numbers for the year 2019 are actually 8.42% in negative territory, with January 2019 showing a 10% loss in the account. A good robot needs to put in consistent performance in delivering profits. Once performance levels drop off, an upgrade or review of the software needs to be done urgently.

Lack of Transparency

The owners of Easy Walker FX have not been very transparent, as certain data from their Myfxbook interface have been blocked off or made private. For instance, the profit performance chart and the account balance chart have been made private, making it impossible to view any data.

The question is: what is it that the Easy Walker FX team does not want the world to see? Are there some hidden data that show something more sinister? Until we see more transparency, it will be hard to trust this software 100%.

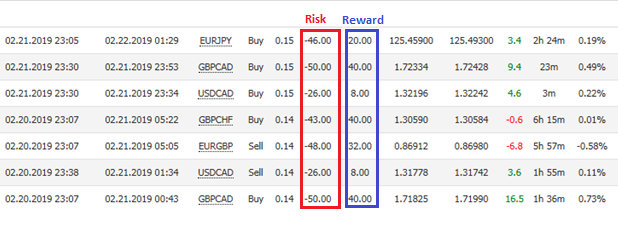

No Regard for Acceptable Risk-Reward Ratios

A good risk-reward ratio should be in the range of 1:2 or 1:3. That is, for every pip set as stop loss, the trade should target to make at least 2 or 3 pips in profit (reward). Easy Walker FX robot has not been obeying this rule. Rather, more risk is being taken for lesser reward.

We can see from the snapshot that more pips are being set as risk (i.e. stop loss), and less is being targeted as profit. This snapshot also shows that the trades are not being allowed to hit either target, but are actually being closed off manually! This means that if the forex robot is actually allowed to trade to completion, the robot may start sustaining a lot more losses than is being let on.

Conclusion: To Trust or Not to Trust?

Easy Walker FX may be profitable over time, but there are some worrying aspects to its operations. There needs to be more transparency. The risk-reward settings as currently playing out, will cause the fx robot to sustain losses with time. Furthermore, the claims of the Easy Walker FX team about the robot’s performance are grossly exaggerated; we need to see the robot trade to completion without manual interference for the true performance to be seen.

So do not trust Easy Walker FX fully. Be cautious if you have to use it.